Euro safe assets and banks' sovereign bond holdings

Watching the Tides - Marchel Alexandrovich

As we wrote last week after the latest ECB rate cut, where policy heads over the coming quarters will be dictated not only by what happens to tariffs and global trade, but also by capital flows and movements in the exchange rate. Between the ECB’s March and June forecasts, the euro appreciated by 8.3% against the US dollar and by 3.9% in nominal effective terms. And, as highlighted in another one of our recent posts (see our Substack on this topic here and send us a message if you would like to see the full research note), there could be further dislocation if global investors decide to significantly reduce their exposure to the US economy and the US dollar.

Without referencing the US directly, the ECB’s Chief Economist Philip Lane touched on this very topic in his latest speech, where he discussed a renewed interest in the international role of the euro. On the estimates published earlier this week, the euro ranks as the second largest reserve currency in the world - its share across various indicators of international currency use stands at around 19%, while its share in global official holdings of foreign exchange reserves stands at 20%. However, one important factor that may be preventing these figures from moving substantially higher is a shortage of euro-denominated safe assets, with Lane putting forward several options for how this shortage could potentially be addressed.

The euro’s role in the international monetary system

Source: ECB

Long-run history of the euro’s international importance

Source: ECB

We first started writing about the idea of European common debt issuance well over a decade ago, during the sovereign debt crisis, and will come back to the subject of Eurobonds in a later post.

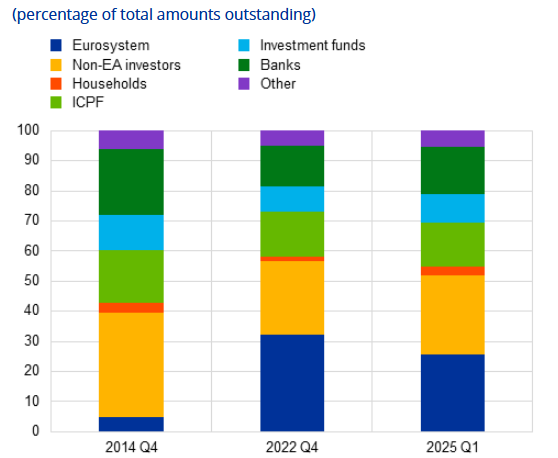

There was another portion of Lane’s speech, though, that caught our attention: the recent shift in the distribution of euro area government bond holdings.

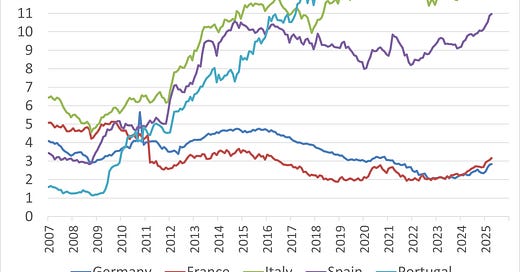

Holdings of government debt of Germany, France, Italy and Spain

Source: ECB

For context, between 2015 and the start of 2023, the ECB bought close to €4trn in euro area government debt as part of its PSPP and the PEPP operations, of which around €550bn rolled off its balance sheet in 2023 and 2024, and another €450bn is due to roll off this year. This, coupled with European government debt issuance of €500-600bn in 2025, means that the private sector will need to absorb close to €1trn of European paper this year. So who is actually buying European government debt as the ECB reduces its own holdings?

As the first chart below shows, one significant source of support has been from foreign investors (red line), who added almost €470bn of euro area debt securities to their holdings in 2024, followed by another €69bn in the first quarter of this year.

The other important development is the increased appetite for European paper from domestic banks. European banks have added almost €450bn to their holdings of European government debt since the start of 2024 – an increase of 28% on the level in December 2023. In terms of the country detail, banks in France and in Germany have been the most aggressive buyers recently, adding €132bn and €81bn of paper over the last five quarters, respectively. Expressed as a share of their overall assets, however, banks in Italy, Spain and Portugal warehouse significantly more debt on their balance sheets - see the second chart below.

Is there a limit to how much government debt European banks will ultimately want to hold? No one obviously knows the answer for certain. But the surge in their holdings since the start of 2024 has been unprecedented. And if their appetite starts to wane, there will be pressure on other buyers - particularly foreign investors - to step up to the plate.

Acquisition of foreign debt by euro area investors and acquisition of euro area debt by foreign investors

Source: Saltmarsh Economics

Holdings of euro area government debt by banks in Germany, France, Italy, Spain and Portugal as a share of their total assets

Source: Saltmarsh Economics

This Substack is reader-supported publication, please consider becoming a paid subscriber. And reach out if you are interested in receiving our research on the BoE, the ECB and climate change, including details of our very own Saltmarsh Economics Climate Index (SECI), that scores and ranks sovereigns on climate risk grounds.

© 2025 Saltmarsh Economics Limited company Number: 13681146

Registered Address: Zeeta House 200 Upper Richmond Road, Putney, London, United Kingdom, SW15 2SH