Understanding EU-US capital flows and market exposure

Watching the Tides - Marchel Alexandrovich

“Do you think that cancelling the tariffs might be enough to restore the trust in the United States now? We have seen this mistrust in the dollar, in Treasuries and so on. Or don’t you think that the environment is getting worse and this is also destroying the faith in the United States?”

“There is a nice African saying which goes “you never swim twice in the same water”. I think for economic players, investors, consumers, employers, employees and all categories, confidence, predictability and a reasonable level of certainty are important factors for them to make decisions.” – Christine Lagarde, ECB Press Conference, 17 April 2025

The unpredictability of everything that’s going on with the US at the moment not only damages world growth prospects for 2025, but more importantly raises fundamental questions about what the new normal looks like for capital allocation once the dust settles. In the near term, it is anyone’s guess who will blink first in the US-China trade standoff, or what happens after Trump’s 90-day tariffs pause comes to an end in early July. And the markets will continue to be battered around by the noise coming out of the White House.

But away from it all, international investors will also be making fundamental decisions about whether, for a number of reasons - including on climate-risk grounds as we continue to highlight through our Saltmarsh Economics Climate Index (SECI) sovereign ratings and asset allocation models - it still makes sense to remain so exposed to the US economy and the US Dollar.

When it comes to the EU-US linkages, politicians in the US tend to focus on the trade in goods between the two regions - although, of course, this discussion really needs to be broadened out to include the trade in services and the overall current account balance (see chart below).

However, the relationship runs much deeper than just through trade flows. From the market’s perspective, what really matters is whether the stock of capital that the two blocs have invested into each others economies starts to shift elsewhere.

Euro area’s current account balance

Source: ECB

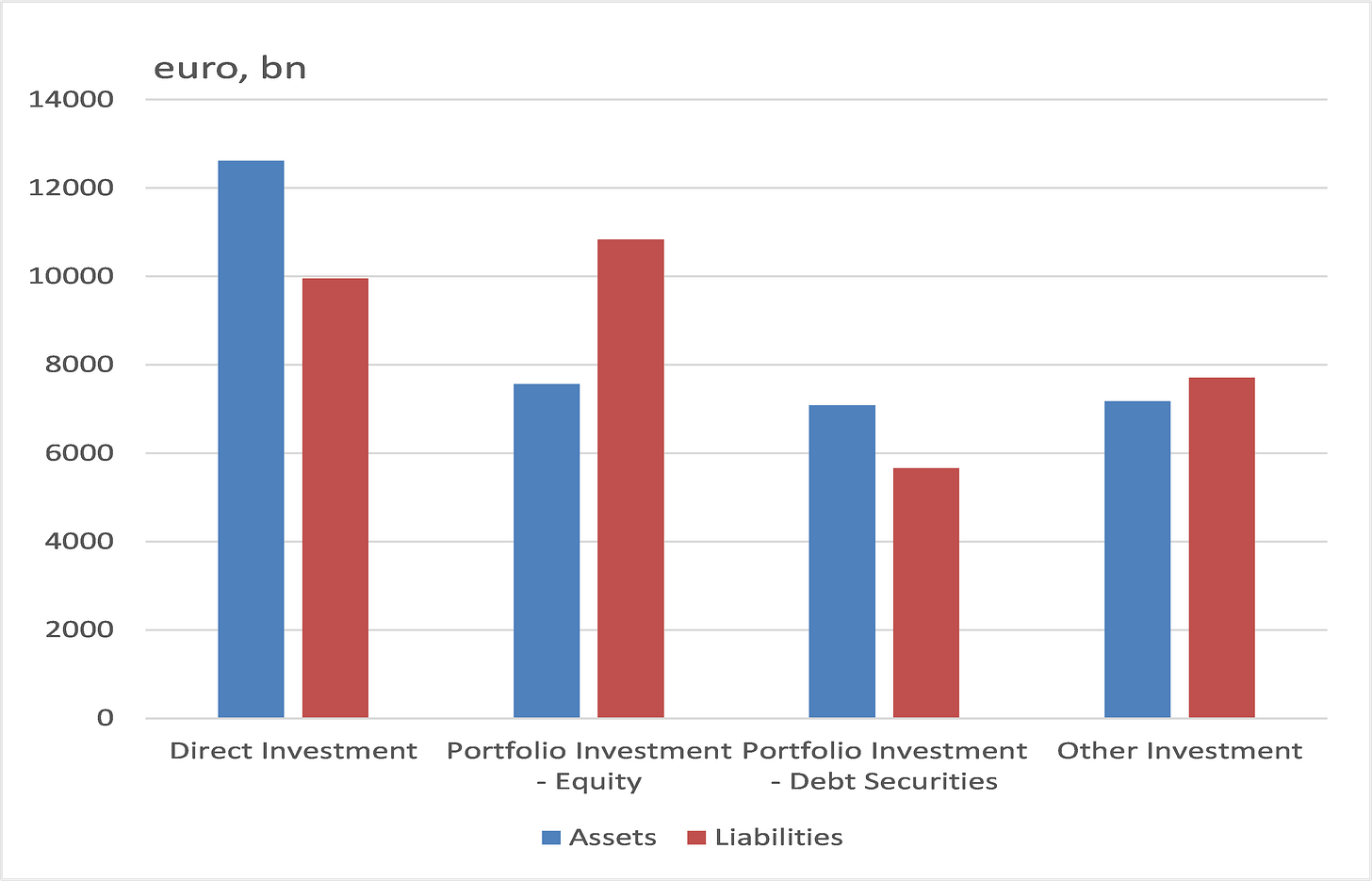

To help put things into context, the euro area’s international investment position with the rest of the world is currently almost in balance: the bloc holds €34.5trn in foreign assets (“assets” in the chart below) compared to €34.2trn of assets in the euro area which are held by foreign investors (“liabilities” in the chart).

From the market’s perspective, however, it’s probably most useful to focus specifically on Portfolio Investment: assets that can move more quickly than, say, Direct Investment into infrastructure. In this category, euro area investors hold €7.6trn of foreign equites and €7.1trn of foreign debt. While foreigners hold €10.8trn of euro area equities and €5.7trn of euro area debt.

Euro area’s international investment position vis-à-vis the rest of the world

Source: ECB and Saltmarsh Economics

Examining the assets side first, the biggest single country exposure of the euro area is, indeed, to the US. As of Q4 2024, 60% of the euro area’s global equity holdings and almost 38% of its debt holdings were in the US market (this will include US Treasury debt, Agency debt and corporate debt). In terms of how these figures evolved, as the chart below shows, the equity market stands out: the share of euro area’s holdings in the US had jumped by 20pp since the start of 2018.

To a large degree, of course, this will be explained by market valuations and US equites outperforming the rest of the world (pushing up their relative value). But, it doesn’t take away from the fact that what happens to US equities really matters for European pension funds and insurance companies.

Share of euro area’s portfolio investment assets which are in the US

Source: ECB and Saltmarsh Economics

On the liabilities side of the euro area’s ledger, as of Q4 2024, US investors held €757bn of euro area debt securities (13.4% of total) and €2901bn of

Keep reading with a 7-day free trial

Subscribe to Saltmarsh Economics to keep reading this post and get 7 days of free access to the full post archives.