ECB: ignore the central forecasts, focus on the risks

Watching the Tides - Marchel Alexandrovich

As expected, the ECB lowered interest rates for the 8th meeting in row at this week’s meeting, pushing the Deposit Rate to 2% - squarely to the middle of the ECB’s 1.5% to 2.5% neutral range. So while the doves on the Governing Council will argue for an additional 25-50bp of easing – and a rate cut will be discussed at the next meeting on 24 July – the ECB is in a different place to where it was last summer.

In many ways, not much has changed since the last ECB meeting in mid-April (or the one before that, in fact), and uncertainty remains elevated. Perhaps the outlook for world trade and the European economy will become somewhat clearer after Trump’s 90-day tariffs pause comes to an end in early July. But, as we’ve seen repeatedly this year, deadlines move around and don’t mean anything to this US administration. And so, it is entirely plausible – likely, even – that trade tensions will continue to weigh on business and consumer confidence, growth expectations and financing conditions for the foreseeable future.

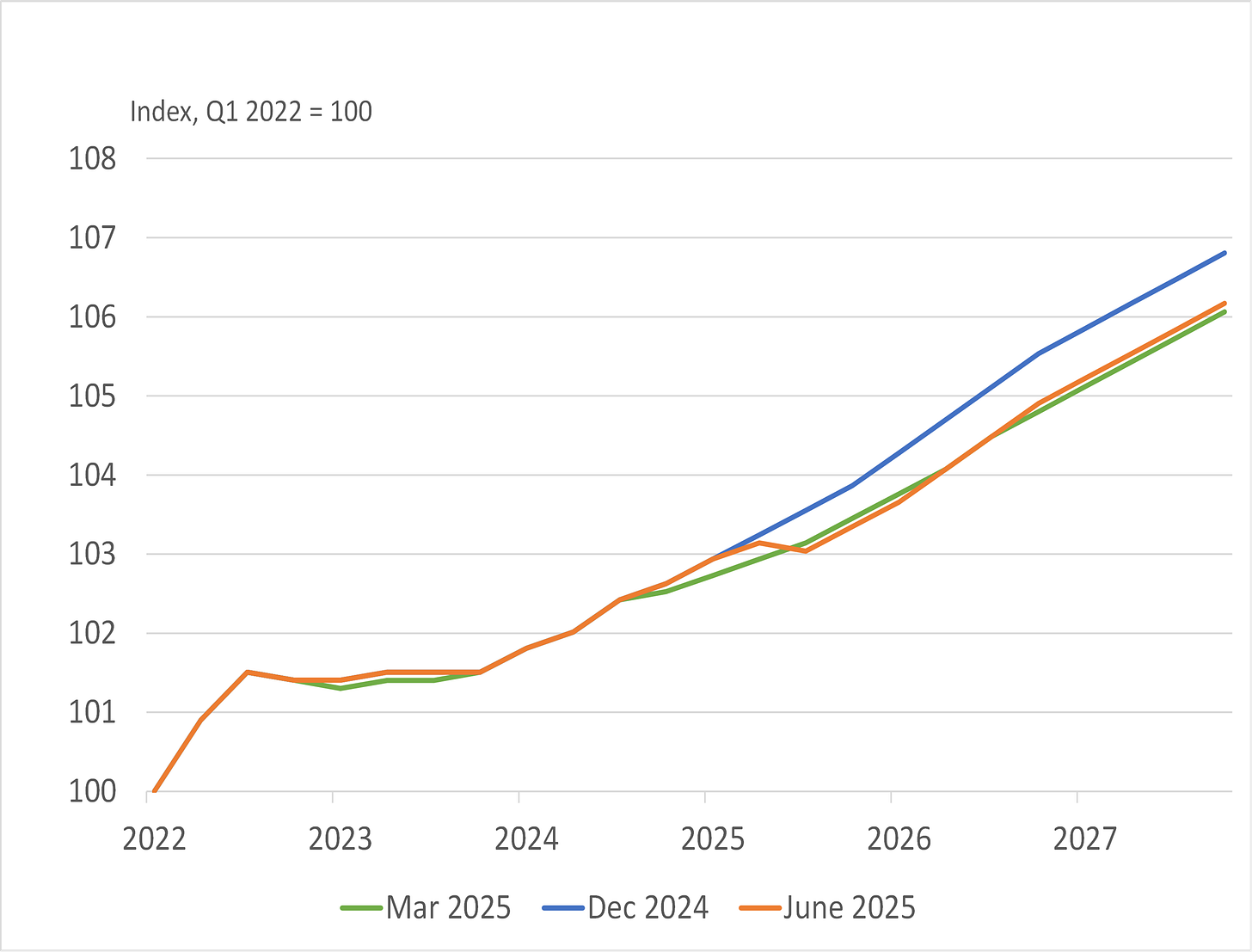

This geopolitical impasse was reflected in the ECB’s new quarterly forecasts. At the end of 2027, the level of euro area GDP is expected to be almost unchanged relative to the previous forecasts made in March (just 0.1pp higher - see first chart below). Similarly, core inflation is expected to average 1.9% in the second half of 2027 – exactly where the ECB was forecasting three months ago (see second chart below).

ECB’s central projection for the level of real GDP in the euro area

Source: ECB and Saltmarsh Economics

ECB’s central projection for core inflation in the euro area

Source: ECB and Saltmarsh Economics

In addition to these central projections – which are based on the assumption that the US tariffs on imported goods would be around 10pp higher than they were last year (20% higher for goods from China) and the EU does not retaliate – the ECB models two alternative scenarios.

In the “mild” scenario, the EU and the United States would reach a deal on eliminating bilateral tariffs, and the US and China would reduce its reciprocal tariffs. Relative to the baseline, by the end of the forecast horizon, the euro area economy would see a cumulative uplift to GDP of around 0.5pp.

Alternatively, in the “severe” scenario, US tariffs would return to the elevated levels announced on 2 April and the EU would retaliate by imposing tariffs on imports of US goods. Furthermore, US tariffs against China would remain at the high level observed before the pause from 12 May at almost 120%. Under this scenario, euro area GDP is expected to experience a hit of around 1pp compared to the baseline.

The ECB’s Chief Economist, Philip Lane, recently discussed the broader implications of deglobalisation, noting that “a phase of deglobalisation could initially dampen economic growth, which would make it more likely that inflation rates would fall. Following that transition, inflation and its volatility could increase as the offsetting effect of favourable imports fades.”

In addition to thinking about what may happen to tariffs and to trade flows, the ECB will also be focusing on capital flows and the exchange rate - although it did not publish explicit scenarios focused on this topic. The euro has already appreciated by 8.3% against the US dollar and by 3.9% in nominal effective terms since the ECB’s previous projections were made in March. And there could be a further dislocation if euro area investors decide to significantly reduce their exposure to the US economy and the US dollar.

Euro area’s portfolio investment position vis-à-vis the US

Source: ECB and Saltmarsh Economics

As we wrote about recently (see our Substack on this topic here and send us a message if you would like to see the full research note), as of Q4 2024, 60% of the euro area’s global equity holdings and almost 38% of its debt holdings were in the US market. And if this capital begins to shift and is reallocated to other parts of the world (including back home), there will be an impact on global government bond yields and the EUR/USD exchange rate, potentially pushing the ECB’s forecasts significantly off track.

To sum up, while its latest central forecasts appear benign, the ECB is fully aware of the enormous risks they face. At this point in time, however, the Governing Council can only speculate about the state of the world it will be responding to in the second half of the year.

This Substack is reader-supported publication, please consider becoming a paid subscriber. And reach out if you are interested in receiving our more detailed research on the BoE, the ECB and climate change, including details of our very own Saltmarsh Economics Climate Index (SECI), that scores and ranks sovereigns on climate risk grounds.

© 2025 Saltmarsh Economics Limited company Number: 13681146

Registered Address: Zeeta House 200 Upper Richmond Road, Putney, London, United Kingdom, SW15 2SH

This is a good read!