As discussed in a post earlier this year - and it is a topic we’ll undoubtedly keep coming back to - the economic relationship between Europe and the US runs much deeper than just through trade flows. Given their impact on GDP data, the trade figures will initially get the most market attention. However, fundamentally, what really matters is whether the stock of capital that the two blocs have invested in each other’s economies starts to shift elsewhere.

From the US perspective, the surge in imports in Q1 (goods imports jumped by over 50% on an annualised basis) is expected to have reversed in Q2, which will help boost the quarterly GDP number. However, until trade tensions settle - and it’s anyone’s guess how quickly this will happen - the data will continue to be battered around by the noise coming out of the White House.

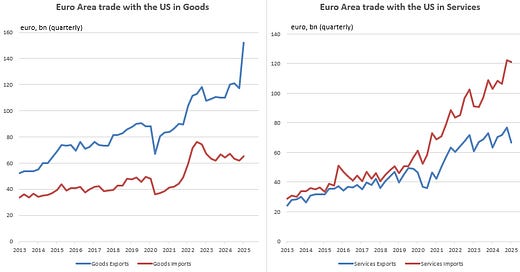

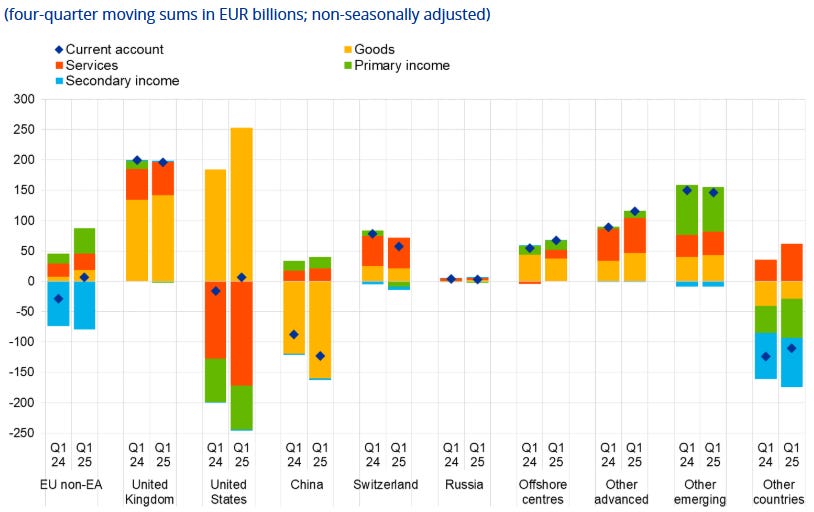

Usefully, we can now also get a better sense of how much US trade volatility is impacting the European economy. The euro area’s exports to the US were almost 40% higher in Q1 2025 compared to Q1 2024, which in turn helped push the region’s current account balance even further into surplus - up to 2.4% of euro area’s GDP, from 2.2% a year earlier.

Euro area’s trade with the US

Source: Saltmarsh Economics and ECB

Euro area’s current account balance by region

Source: ECB

As already mentioned, though, what the markets should also be interested in is what the new normal looks like for capital allocation once the trade data settles. Specifically, will European investors want to remain so exposed to the US economy and the US dollar, given everything that’s going on around its politics and its monetary and fiscal policy? (We can also add to the mix that the US is more exposed to climate risk factors than many other DM economies, and it scores poorly on our own Saltmarsh Economics Climate Index (SECI))

Similar concerns are, of course, regularly raised domestically across Europe — so there is absolutely nothing special to see here by international standards. But that is precisely the point: for decades, the US was special, and its markets benefited from foreign capital flows attracted to the stability and growth prospects that were lacking in other parts of the world.

How much does the US matter for European investors? On the latest figures, 59% of the euro area’s global equity holdings and 37% of its debt holdings were in the US market (this will include US Treasury debt, Agency debt and corporate debt). So, there is a huge amount at stake for both sides if the attractiveness of the US economy and its markets starts to wane.

Share of euro area’s portfolio investment assets which are in the US

Source: ECB and Saltmarsh Economics

© 2025 Saltmarsh Economics Limited company Number: 13681146

Registered Address: Zeeta House 200 Upper Richmond Road, Putney, London, United Kingdom, SW15 2SH