Another week, and further (very sensible) calls for the Chancellor, Rachel Reeves, to tweak the UK’s fiscal rules to allow more public sector investment (but please, no more major cost-benefit disasters, like HS2), and, in our view, misleading opinion pieces about how QT in the UK has operated.

Contrary to what is often suggested, foreign central banks have not been the only buyers of Gilts as the BoE has actively been shrinking its balance sheet. Domestic pension funds and insurance corporations have, in fact, been even bigger buyers.

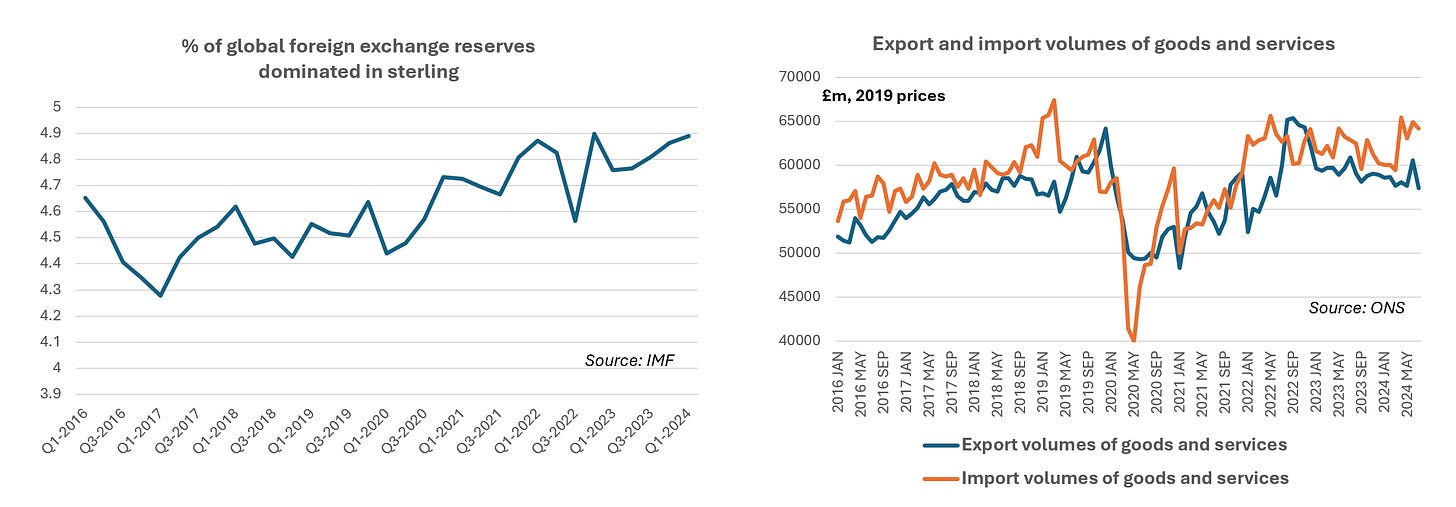

Moreover, foreign central bank buying of Gilts has been during a period when total global foreign exchange reserves have risen significantly (by almost almost $1.5 trillion since Q1 2016).

As of Q1 2024, 58.9% of global foreign exchange reserves were held in US dollars, 19.7% in euros, 5.7% in the Japanese yen and 2.2% in the Chinese renminbi. Since Q1 2016, global reserves held in sterling have only risen from 4.7% to 4.9% (see first chart).

Before moving on to the OBR’s assessment of UK fiscal risks, the fact that UK GDP has flatlined for 2 consecutive months has to be put in context, especially as it flies in the face of upbeat survey evidence (including the survey of CFOs conducted by the BoE). We suspect a breakdown on the expenditure measure of GDP will once again reveal the importance of the weakness of net trade, in July’s 0% GDP print.

We know that export volumes fell by 5.1% in July, import volumes by a much more modest 1.1%, driven by lower chemical exports to both EU and non-EU countries. At the end of the day, UK domestic demand could still be growing by close to 2% on year.

Meanwhile, August payroll data (which has a habit of leading the more widely quoted LFS survey) accelerated to 6.2% YoY, from 4.3% YoY in June, as one-off payments made to NHS workers and civil servants in 2023 dropped out of the Year on Year comparisons. And, as we highlighted in a Substack last week, CFOs expect wages to rise by 4.1% in the year ahead in the private sector, compared to the BoE MPC’s August forecast of 3% for 2025 overall (a figure required to be consistent with the MPC’s 2% target, with only 1% productivity growth).

According to real time indicators published by the ONS, the total number of online job adverts on 6 September 2024 (although 2% lower than the equivalent period of 2023) increased during the last week, returning to the level seen in early August 2024.

And, as Marchel highlighted in a research piece last week, a deep dive into the data shows that 45% of the core inflation basket (72 components analyzed) in the UK is still registering price rises of over 5% on year, a much higher figure than seen pre-COVID and very different to what is now being seen in the US.

This all helps sets the backdrop for the BoE’s next interest rate and QT decision (Thursday) - as should the fact that, despite a reclassification of the Natwest Group from the public sector to the private sector, public sector employment in the UK grew by 1.3% (76,000) in the year to June, led by a 3.3% increase in numbers employed by the NHS.

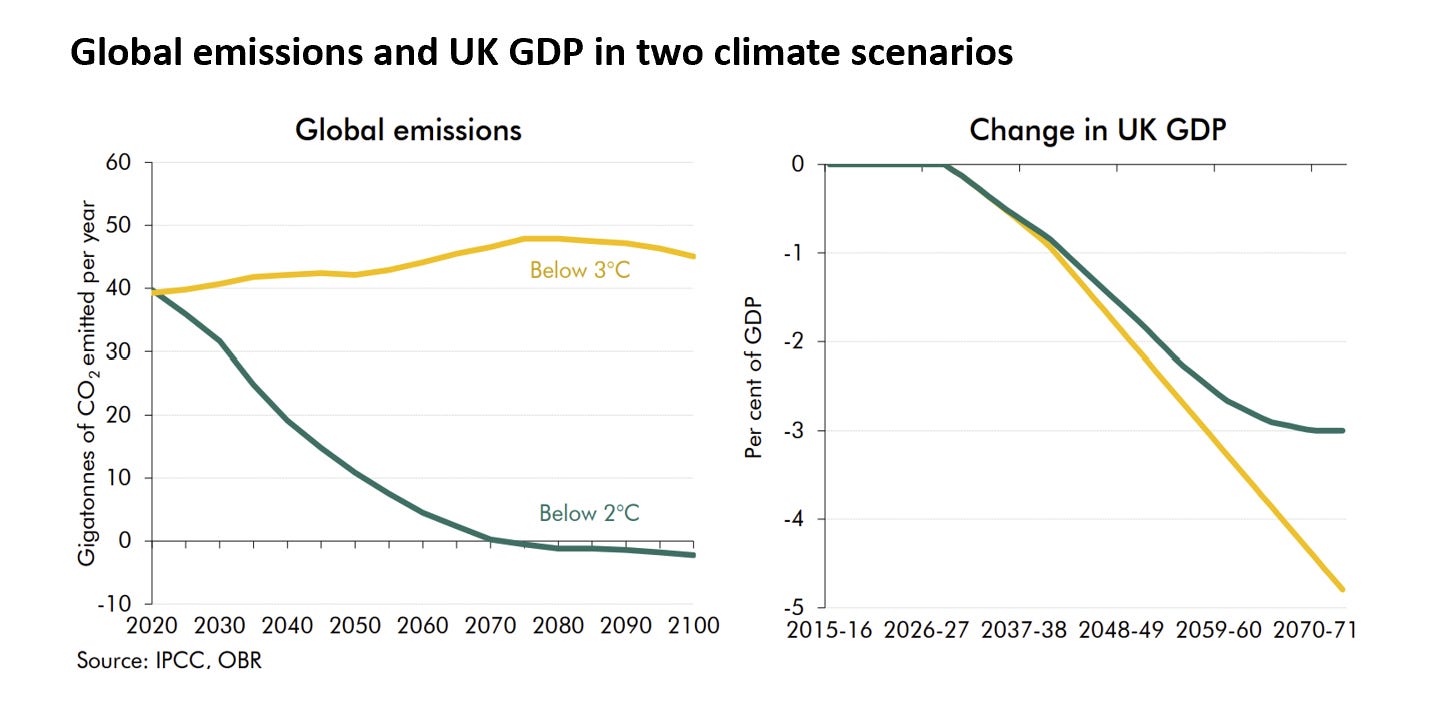

What then of the OBR and climate change?

Please consider becoming a paying subscriber to continue reading on.