November: the key month for the BoE to reframe discussion on UK rates

Views From the Marsh - David Owen

We have long argued that November was the key month for the BoE to reframe discussion on UK rates.

This follows Rachel Reeves’ first landmark Budget and gives sufficient time for Clare Lombardelli, the new Deputy Governor for Monetary Policy, to determine how to present a revamped Monetary Policy Report, in light of the Ben Bernanke Review, which stressed the need for the Bank to present more scenario based analysis.

November (the decision will be announced on Thursday 7th) will also give more time to determine how quickly underlying inflation pressures are abating - still relatively slowly, according to Catherine L Mann’s latest speech - and will be followed by the BoE’s Watchers’ conference. Worth noting that the BoE’s Watchers conference is now very different to that of a few years ago - more on such things later.

As such, there should be no real surprise that the BoE kept rates on hold last week. £100bn of QT in the coming year may also have been largely expected, but on balance was the least amount that the Bank could have really announced given the heavy flow of Gilt redemptions in coming months.

The Bank has stressed the role that longer-term repos may increasingly play as the BoE’s balance sheet shrinks, alongside a fall in reserves. However, this is still being missed in most of the commentary we have seen on the subject.

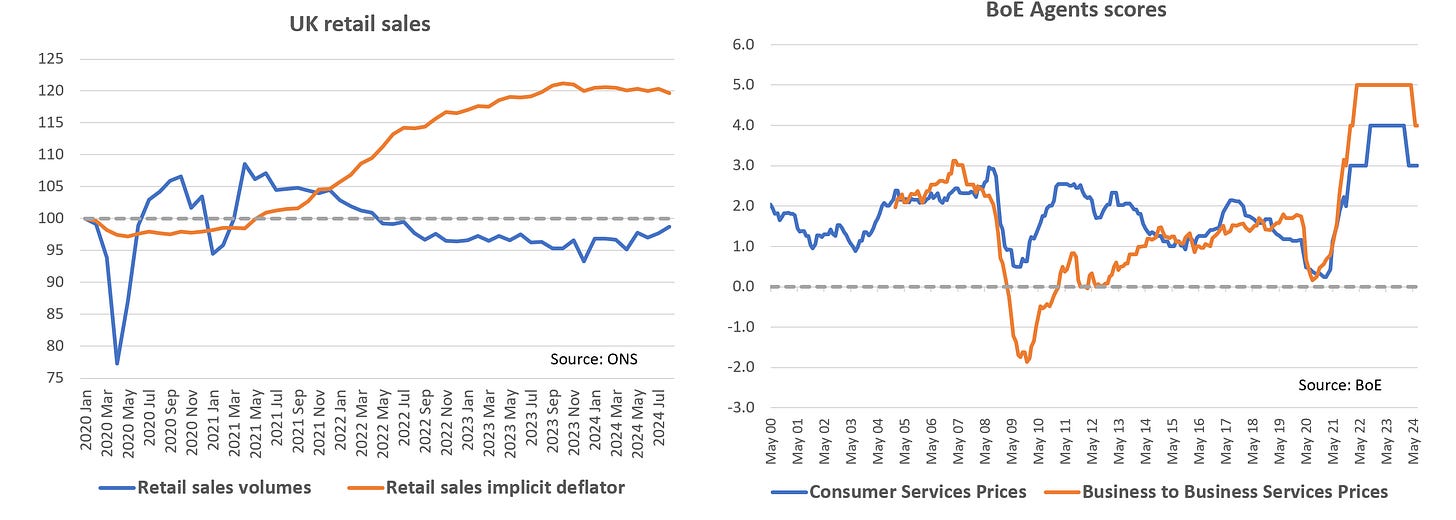

Meanwhile, the Bank reported last week that firms are rebuilding profit margins and anticipate a 1.2 percentage point increase in their operating profits to sales ratio over the course of 2024. According to a BoE survey, 47% of firms expect to increase profit margins in the year ahead, only 16% expect them to decrease. And, this is against the backdrop of expected wage growth of 4%+; on the face of it, hardly consistent with all those market participants surveyed, at pretty much the same time, who expect Bank Rate to fall to between 3.5% and 4% by September 2025.

Can we really be surprised if running into an election, central government current expenditure was rising faster than tax receipts? But, when it comes to the Budget, the key judgement calls that the BoE will have to make will be, what does it imply for the change in the underlying fiscal stance (a tighter, or looser fiscal stance); and will it move the dial as far as the longer term supply-demand mix is concerned?

And how much weight should be placed on a stronger sterling, a currency pushed higher by expectations of divergent monetary policies? - more on this in a moment.

Please consider becoming a paying subscriber to continue reading on, where we discuss in more detail the implications of divergent monetary policy and the potential importance of the BoE’s Watchers conference.

Keep reading with a 7-day free trial

Subscribe to Saltmarsh Economics to keep reading this post and get 7 days of free access to the full post archives.