With euro area inflation dipping below target in May - the annual rate declined to 1.9% YoY from 2.2% YoY in April - the ECB’s long-held belief that inflationary pressures in the region would ease significantly in 2025 is becoming a reality. However, as the ECB discussed in a recent publication, disinflation is proceeding at very different rates across the various parts of the inflation basket, which is partly a function of seasonality and how often prices are reset for certain services.

In terms of the current inflation dynamics, there are two main factors that have helped to push headline inflation lower since the start of the year. On the one hand, inflation in the “Energy” component of the euro area HICP inflation basket (9.4% of the total weight) dropped from +1.9% YoY to -3.6% YoY. On the other, there has been a significant decline in “Services” inflation (45.6% weight in the total inflation basket), which fell to 3.2% YoY in May from 3.9% YoY in January. This is what grabs the headlines. But over this same period, inflation in “Non-energy industrial goods” (clothing, appliances, etc.; 25.6% weight) has drifted sideways, while inflation in “Food, alcohol and tobacco” (19.3% weight) actually rose from 2.3% YoY to 3.2% YoY.

The other point to keep in mind is that Easter Sunday fell much later this year than in 2024. This had an impact on the monthly movements in the core inflation index, with prices jumping by 1.02% in April 2025 (compared to a rise of 0.70% in 2024) but then recording a much weaker print in May (-0.02% in 2025 vs. 0.44% in 2024), which helped push the annual rate of core inflation down by 0.5 percentage points on the month.

Euro area inflation by category (weight of component in bracket)

Source: Saltmarsh Economics

Euro area core inflation index and the timing of Easter

Source: Saltmarsh Economics

What’s our assessment of the inflation data in the euro area at the moment? Unquestionably, the picture looks more encouraging than it did a year ago, but things are by no means back to ‘normal’ either. For example, according to our Inflation-Deflation Monitor calculations, close to 60% of items in the euro area core inflation basket are still seeing annual inflation of over 2% YoY, and almost 9% of items are recording inflation of over 5% YoY (in Germany, this share stands at almost 15% of the core inflation basket).

Get in touch if you would like to discuss our work on inflation in more detail.

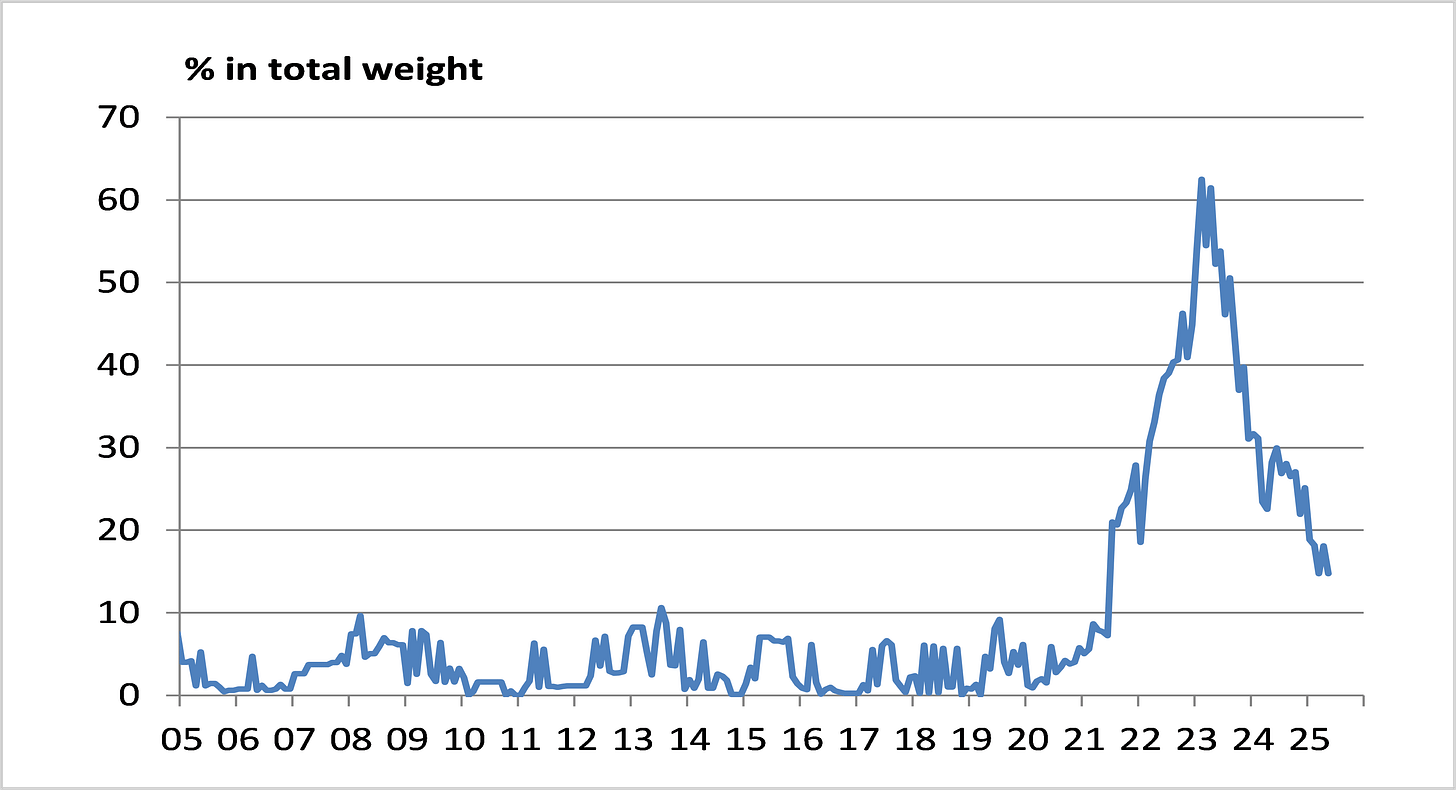

Share of Germany’s core inflation basket with inflation rate above 5% YoY

Source: Saltmarsh Economics

Returning to the point about the seasonality of price changes in the euro area, the ECB’s analysis helps to draw a useful distinction between the prices of services that are adjusted regularly throughout the year and those that are adjusted infrequently.

For instance, while some components of the services inflation basket (air transport is given as a good example) are extremely volatile, other components - such as rents, health insurance and “administered” services (which include things like education, water & sewage costs etc) - will typically see only an annual repricing, which is likely to take place around the start of the year (same, of course, as when the majority of wages are adjusted).

Month-on-month change for selected euro area HICP services items

Source: ECB

Overall, the ECB estimates that, “around a quarter of all services items are concentrated in one or two months of the year.” And the reason why this is important is because it leads to some inflation stickiness. As the ECB describes, “in January 2025 annually repriced items with administered prices showed the strongest month-on-month increase, which even surpassed the rise seen a year ago.” On the other hand, “price changes in non-administered annually repriced items eased compared with the previous year.” Meanwhile, “the inflation rate of services items without a repricing pattern has also declined visibly as of January 2025.”

What do these conclusions mean in practice? One broad takeaway is that disinflation (and inflation) comes in waves, with the prices in services that are adjusted once a year - particularly administered services - playing catch-up with the price developments in the wider economy, including changes in energy costs. Specifically as it applies to this current juncture, the ECB expects services inflation to slow further in early 2026, as the base effects from the large price movements at the start of this year begin to drop out of the annual inflation calculation.

Euro area HICP services items with an annual repricing pattern

Source: ECB

This Substack is reader-supported publication, please consider becoming a paid subscriber. And reach out if you are interested in receiving our research on the BoE, the ECB and climate change, including details of our very own Saltmarsh Economics Climate Index (SECI), that scores and ranks sovereigns on climate risk grounds.

© 2025 Saltmarsh Economics Limited company Number: 13681146

Registered Address: Zeeta House 200 Upper Richmond Road, Putney, London, United Kingdom, SW15 2SH