ECB revises its core inflation forecasts, prepares for further rate cuts

Watching the Tides - Marchel Alexandrovich

As expected, the ECB delivered a 25bp rate cut at this week’s meeting and signalled that it expects to ease policy further in the coming months. Lagarde stressed that the Governing Council does not have a set policy path in mind and that its decisions will continue to be data dependent. This suggests that the ECB sees no urgency to move at consecutive meetings and will pause on 17 October, before cutting rates again on 12 December.

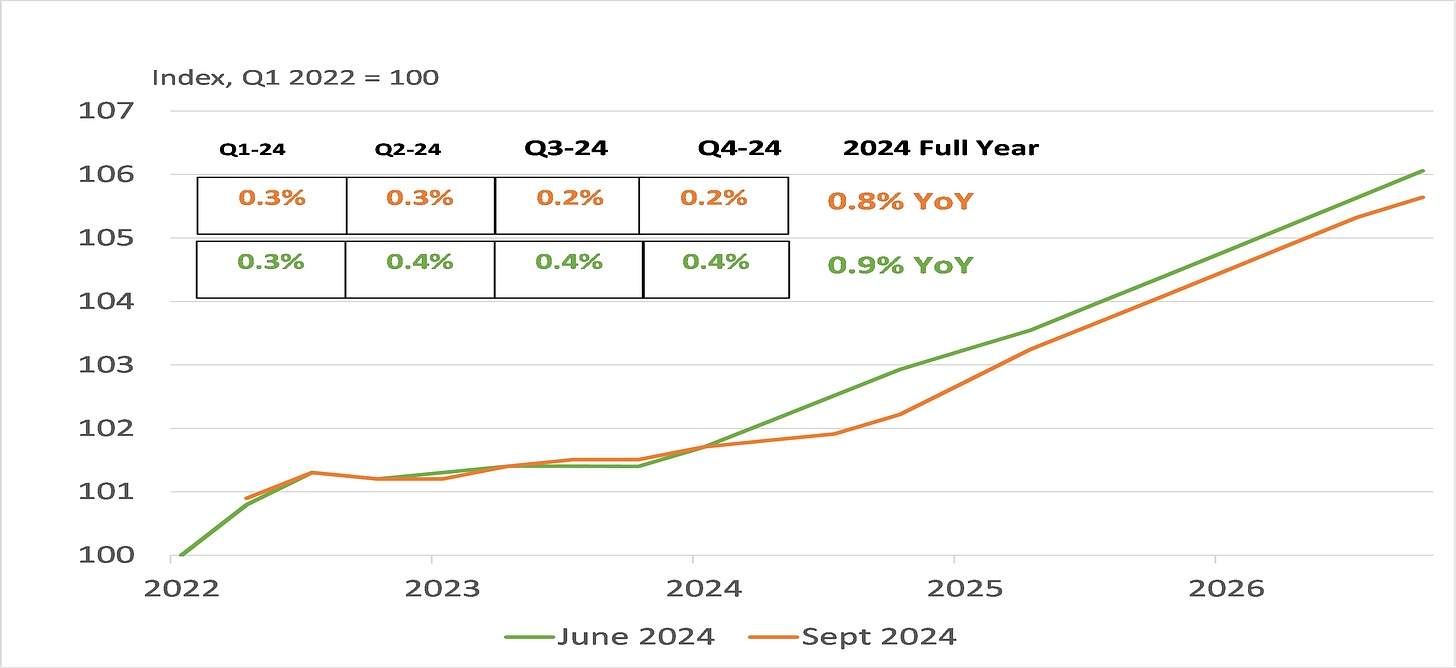

Both in terms of the forward guidance and the macro forecasts, the ECB followed its playbook from June, with one twist. The new quarterly staff projections show a small downward revision to GDP growth forecasts for this year and for 2025 & 2026, such that by the end of 2026 the level of euro area GDP is expected to end up 0.5pp lower than anticipated in June. At the same time, the forecasts for headline inflation show the same year average figures for the next three years as the ECB was pencilling in previously.

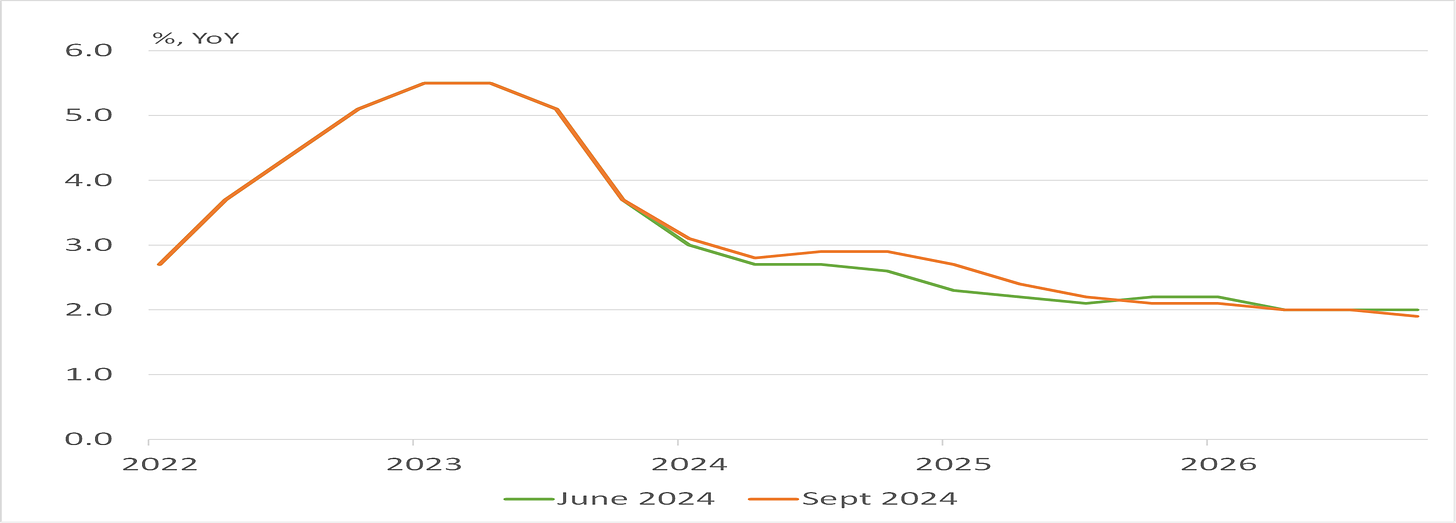

The most noteworthy change is to the projections for core inflation. Given the stickiness of services inflation, it came as no surprise that the ECB revised up its forecasts for core inflation to 2.9% from 2.8% for this year, and to 2.3% from 2.2% for 2025.

The year average figure for 2026 was left unchanged at 2.0% YoY. However, the quarterly numbers now show core inflation at 1.9% in Q4 of 2026, compared to the previous forecast of 2.0%. No question, this is a very minor change when thinking about a forecast two years away. However, it does send a signal about the ECB’s growing confidence that, eventually, as wage growth slows so will underlying inflation, giving it room to continue to move rates lower towards the neutral level.

ECB’s projections for real GDP growth

Source: ECB and Saltmarsh Economics

ECB’s projections for core inflation

Source: ECB and Saltmarsh Economics

Please consider becoming a paid subscriber to our work. And send us a message if you would like to receive our full research report on this topic.

© 2024 Saltmarsh Economics Limited company Number: 13681146

Registered Address: Zeeta House 200 Upper Richmond Road, Putney, London, United Kingdom, SW15 2SH

Saltmarsh Economics is a reader-supported publication. To receive new posts and support our work, consider becoming a free or paid subscriber.